India and the World Nations- Reasons for Increased Business Insolvencies in 2021

Vee Track is media monitoring service provider keeps track of print, electronic and social media for the client’s brands. In the technology driven world having up-to-date data and analytics is imperative. From maintaining a successful campaign to deciding product launch, analysis, and insights from the data on your brand is crucial. Vee Track helps you with those data, analysis, and insights, making you competitive in the market.

Here are our insights on ‘Business Insolvencies 2021’ with our media analysis. We have tracked, observed, and analyzed the topic.

Insolvencies happen when businesses cannot pay back their debts. When a company cannot pay back its debt on due it can file for a bankruptcy legally. The money taken from the company’s assets are divided among the creditors. Rules to file for bankruptcy varies from a country to country. Most of the time, it is based on the outstanding debt being much higher than the value of the company’s assets.

Covid-19 pandemic hold large part in business insolvencies for the year 2021. The governments around the world have restricted business operations due to mass spread of infection in 2020. The companies or SMEs must undergo the lockdown. Business sectors that have operations related to retail and travel faced a serious financial issue. Even they have to file for a bankruptcy.

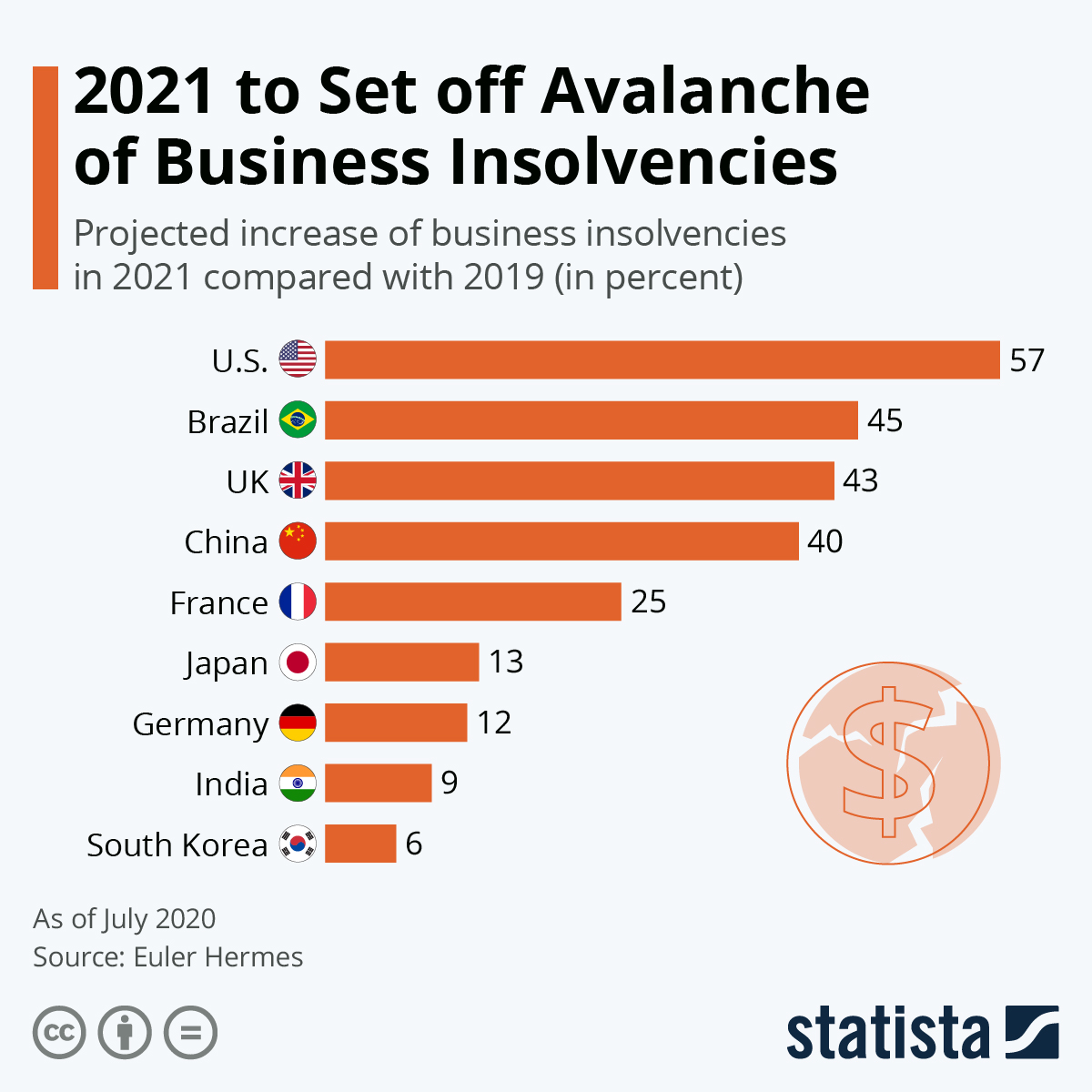

Figure 1

Euler Hermes says the pandemic is “creating an insolvency time bomb”. They predict bulk insolvencies around the world that would come up even after economies start growing after lockdowns, especially between the end of 2020 and the first half (H1) of 2021. They list out possible reasons: uneven initial conditions/ differing reopening conditions and emergency policies particular to insolvencies. Expected insolvencies for the globe is +35% by 2021 for the cumulation of two-year period. Half of the countries analyzed have a new high record ever since the last financial crisis in 2009.

Global Index of Insolvencies expected in 2021

Euler Hermes identifies two sets of countries: one set have a strong rise in insolvencies in 2020 and the other have delayed surge in 2021.

The category one countries are the US and most of the APAC countries, except India. The US will see the largest spike of +47% y/y in 2020 and +57% by 2021. Brazil will have an expected +45% insolvencies and China with +40% insolvencies by the end of 2021. APAC countries like Singapore with +39% insolvencies; Hong Kong with +23%; Japan with +13%; and Australia with +11%.

India, the UK, and France comes under category two countries that would have delayed surge in insolvencies.

India’s position in insolvencies in 2021

Euler Hermes expects one out of the three countries will have delayed acceleration of business insolvencies, with a hike in 2021 compared to 2020. Particularly India, due to the impacts of lockdown to business activities, suspension of judicial functioning and insolvency laws until clarity in business functioning by the end of 2020, will have delayed surge.

CMIE reports recovery rate of Insolvency and Bankruptcy Code (IBC) falls to 39.3% as of March 2021. In March 2020 the recovery rate is 46%. Business insolvency rate has gone up by 6.7%. Euler Hermes expects the rate to increase to 9% in 2021.

Reasons for India’s Business Insolvencies:

1.Covid and Lockdown aftereffects on prevailing economic unrest

The outbreak and consecutive lockdowns have sped up the prevailing economic downfall. Before covid, the world is undergoing business insolvencies rise for 4th consecutive year. This sudden lockdown is critical for the already weak companies. The sectors that got the hardest hits are transportation, automobiles, non-essential retails, hotels, and restaurants. Though lockdowns hit most of the sectors, IT and pharmaceuticals tend to come back with resilience. Lockdowns affected the company’s liquidity as restarting the business needed capital.

Carnegie India notes India’s economic slowdown has opened space for growth than do the economies of the developed countries. But by clearing the gap in bankruptcy law, India can achieve a faster growth.

2. Laws of Bankruptcy

Insolvency and Bankruptcy Code (IBC) plays a crucial role in the financial system. It allows the inefficient firms or firms that cannot pay back debt to die off with minimal disruption. This inflexibility to borrowers led to dissatisfaction in several quarters. It encourages reallocating funds to the most “well-off” or productive companies. This law is against already weak business and hits hard. A research paper says the suspension of the laws and the problems with the existing design can inhibit allocative process in the economy.

Euler Hermes anticipates a global surge of +35% in business insolvencies by the end of 2021. Unlike the last financial crisis between 2007-09, this crisis can increase up to double digits in insolvencies by 2021.This is ultimately due to unrest of economic conditions and bankruptcy policies.

On what do you need insights?

Is there any business analysis, market trends, industry insights or a topic you would like Vee Track to give insights on? We want to hear from our readers to give them what they want.

You can write your suggestion or ideas to us.

Reference:

Figure-1 :

https://cdn.statcdn.com/Infographic/images/normal/22996.jpeg